Slow economy affects banks, profits continue to decline

We use Google Cloud Translation Services. Google requires we provide the following disclaimer relating to use of this service:

This service may contain translations powered by Google. Google disclaims all warranties related to the translations, expressed or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose, and noninfringement.

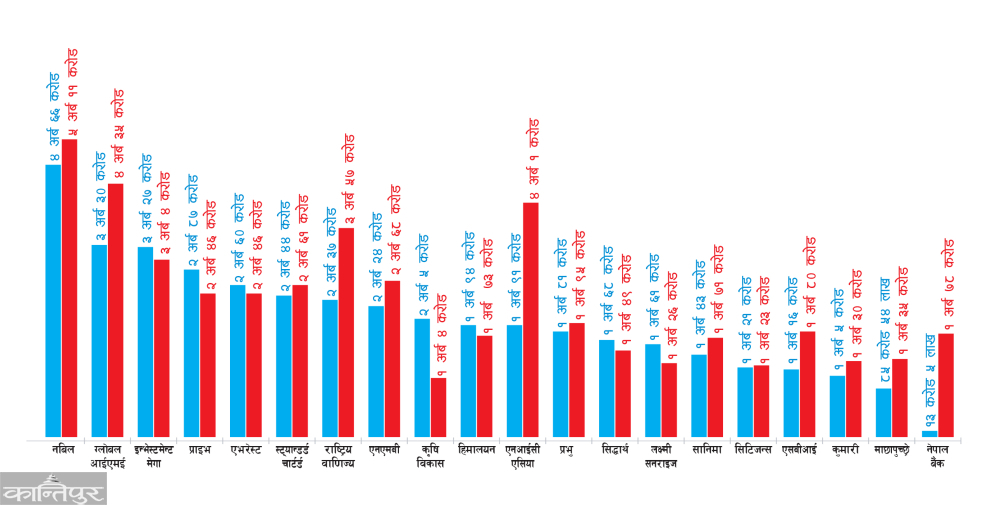

By the third quarter of the current financial year, 20 commercial banks have earned a total net profit of 40 billion 68 million rupees. Compared to the same period of the last financial year, this is about 13 and a half percent less. By the third quarter of the last financial year, the net profit of these banks was 47 billion 1 crore rupees.

Experts say that the profit of banks is continuously decreasing due to the prolongation of economic stagnation, falling interest rates, lower than expected loans, increase in bad loans due to non-recovery of loans. Compared to the second quarter of the last financial year, the net profit of banks decreased by about 8 and a half percent during the same period of this year.

Banks' withdrawals are still not regular, bad loans are increasing. The effect of this has been seen in the profits," says Sunil KC, President of Nepal Bankers' Association, "Compared to the third quarter of last year, the interest spread between banks' loan deposits has decreased during the same period of this year. Banks that merged last year had higher spreads.'

Loans have not been able to expand as deposit collection has increased. KC said that the investment due to the lack of credit expansion had to be invested in financial instruments with low interest rates. "At this time last year, investing in government bonds used to earn a lot of interest, this year it has decreased by a lot," he added. According to him, the effect of the relaxation in economic activities, decreasing spreads, low credit disbursement, increasing bad loans and other reasons have been seen in the profitability of banks.

According to the unrefined financial statements published by the banks, the net profit of 13 banks has decreased by the third quarter of the current financial year, while the remaining 7 have increased. Nabil became the first bank to earn the highest profit by earning a net profit of Rs 4.66 billion. While the profit of this bank till last March is about 9 percent less than the profit of the same period last year. Nepal Bank has been seen to earn the lowest net profit till the third quarter. Till last March, the net profit of this bank is only 13 crore rupees. During the same period last year, such profit was 1 billion 78 crore rupees.

Compared to the third quarter of last year, banks' interest income has decreased significantly this year, while bad loans have increased. This shows that on the one hand the spread of banks has decreased and on the other hand the loans that have been raised have not been recovered. Especially now, two types of loans are seen in the market. One of the problems in the economy (circumstantial reasons) is that borrowers have not been able to pay the principal and interest, while others have not paid even though they have the capacity. Experts say that bank loan recovery has also been affected by the increasing negative activities in the society especially towards the financial system. The average bad loans of commercial banks for 20 years till last March is 3.59 percent. It was 2.95 percent till March 079.

According to experts, the interest income of most of the banks has decreased since the interest difference (spread) has decreased compared to last year and this has affected the profit. Banks' operating profit has not increased. Because compared to last year, the interest income of banks has decreased comparatively,' said Bhuvan Dahal, the former president of Nepal Bankers' Association, 'Non-performing loans of most banks have increased, this has increased the loss arrangement.' The National Bank has given facilities to banks and financial institutions to reschedule and restructure loans worth more than five million rupees in the region. Due to this facility, bad loans of banks and financial institutions are very less now, experts say. "If there was no loan rescheduling and restructuring facility, the bad loans of the banks would have increased," said the chief executive officer of a commercial bank. However, there is no expected improvement in loan demand.'

According to the existing system, loans of up to 50 million rupees disbursed by banks and financial institutions in all sectors and loans related to hotels and restaurants, animal husbandry, construction education, health sector loans and loans invested in projects affected by natural/divine disasters such as floods, landslides, and earthquakes will be rescheduled and restructured until 2080. have been able to do.

Earlier this feature was only available till 080 June. At present, banks and financial institutions have arranged only 1.25 percent loan loss on good loans. Earlier, 1.3 percent loss provision had to be made on good loans. Sources claim that this system also did not allow the loss system to increase much.

Until last February, deposits in banks and financial institutions have increased by 4 trillion 35 billion 87 crores. This is an increase of 7.6 percent. During the same period last year, such deposits increased by 2.80 billion 57 crores (5.5 percent). According to the National Bank, deposits in banks and financial institutions increased by 14.6 percent at the end of February 2018 on an annual basis.

Until last February, banks and financial institutions have provided loans of only one trillion 99 billion 50 crore rupees. This is an increase of 4.2 percent. During the same period last year, such loans increased by 1 trillion 28 billion 18 billion (2.8 percent). On an annual point-by-point basis, at the end of February 2018, government data shows that loans from banks and financial institutions to the private sector increased by 5.2 percent. For the current fiscal year, the National Bank had set a target of expanding credit by 11.5 percent. While credit has expanded by only 4.2 percent for eight months.

प्रकाशित : वैशाख ९, २०८१ ०७:५४

प्रकाशित : वैशाख ९, २०८१ ०७:५४

२४.१२°C काठमाडौं

२४.१२°C काठमाडौं