Prudent use of public debt

We use Google Cloud Translation Services. Google requires we provide the following disclaimer relating to use of this service:

This service may contain translations powered by Google. Google disclaims all warranties related to the translations, expressed or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose, and noninfringement.

Discussions about the budget for the next financial year have already started. Every year in mid-November, the budget season begins when the National Planning Commission calls on local governments and state governments to submit (request) supplementary and special plans.

After the Finance Minister's budget speech through various stages, this climate changes at the center and gradually moves towards the states and local bodies. May 15th can be called 'Budget Day' as Article 119 of the Constitution of Nepal stipulates budget (estimate of revenue and expenditure).

In developing and underdeveloped countries, the demand for development budget is high, but the resources for it are less, so the practice of deficit budgeting is more common in these countries. To manage the deficit budget, instruments such as foreign aid and internal and external loans are relied upon. Due to various reasons foreign aid is decreasing, we have no other option but to borrow. The government thus has to rely on internal and external sources while borrowing public debt.

If the internal debt is taken more, the private sector will face some difficult situation, there will be a liquidity problem in the market, interest will increase, investment will be discouraged and in that case inflation will also increase. Underdeveloped countries like Nepal have a tendency to make budgets by giving more priority to external debt. We have also been doing this practice for a long time.

External loans require the mobilization of bilateral and multilateral resources. In Bilateral Sources, the government of Nepal can borrow from the government of any other country on the basis of bilateral relations. The major multilateral sources are World Bank, International Monetary Fund, Asian Development Bank, European Union and Asian Infrastructure Investment Bank etc. Such resources are also very important in terms of cost and budget management of Nepal. Our journey towards prosperity will be easy only if we know the demand of time and make proper use of it.

method of measuring

The method used to measure how good a country's debt is is to calculate the percentage of the country's gross domestic product. If the total amount of debt is measured in currency, it depends on the size of the economy. Therefore, when measuring such debt by comparing it with the size of the economy, this is done because the carrying capacity of the debt is evident. That is, large economies have more debt carrying capacity and smaller economies have less debt carrying capacity. This is done because both large and small economies can be measured on the same scale. Even when measured in this way, it is not determined what percentage of GDP is good debt. Some studies have considered 60 percent of the GDP as the limit, while others have put it at two-thirds. Therefore, it is also found that different countries determine the limits of such loans so that they can maximize their production capacity. It has been nearly seven decades since

began planned development. But we have not yet built a modern city worth seeing, nor a rural settlement. Most of the habitable land and in some cases even the arable land were used as settlements. Due to this, if we don't think about it from today, it will be a very difficult task to develop cities and settlements in the future. We said that we will build 10 smart cities in the last decade, but due to political strife, we could not build even one. Due to the lack of investment, the projects of national pride that we have announced in the past are stalled, while the liabilities created in other projects are also demanding more investment. If they cannot be given budget this year too, billions of rupees invested in the past will automatically turn into losses.

Even in the capital of the country, the capital of the state, the district headquarters, i.e. the city we mentioned, we have not been able to distribute potable water from the tap. We distributed electricity with great pains, but due to lack of investment, its supply has not been reliable and until this is done, productivity will not increase. The state of sanitation is challenging our civilization. A large amount of investment will have to be made in the fields of education, health and sports. If we don't invest in sustainable infrastructure now, targeted economic growth and prosperity will be just a dream. Digital infrastructure must also be built in schools and administrative systems. Apart from a few in Bhatbhateni and Kathmandu, there are no commercial buildings anywhere. It's been decades since we started talking about public private partnership, but we haven't seen much of a new commercial example of that kind. For that too, sufficient investment will be required from the government. Therefore these works should be started as soon as possible. If this is not done, the confidence of investors will not increase here, nor will the youth who have seen the modern world. And how does the economy run? Economic activity in the country does not increase due to the large number of people who can consume, some signs of this have already started to be seen in Nepal's economy. We need to understand this reality. Without borrowing, there is not much fiscal space in our budget. Therefore, public debt is important for the prosperity of the country.

While discussing the importance of public debt, the question arises as to how much we have benefited from it. On the other hand, there are also questions about how prudently we have spent the loans we have taken. In some cases, we are unable to pay the loans we have committed to take. According to the data till the end of last January, Nepal's public debt has reached about 24 trillion rupees, which is about 44 percent of our gross domestic product. Talking about this century, around 2003 it reached about 53 percent. Among our latest public debt, the situation of internal and external debt is not much different, internal is 11.84 billion and external is about 12 billion. Multilateral debt accounts for more than bilateral debt in our external debt, at around 87 percent. External debt has been weaker than target compared to domestic debt, while interest on external debt is cheaper, although exchange rate risk is higher. External debt should be our priority in terms of investment in today's situation, as in other underdeveloped countries.

situation in other countries?

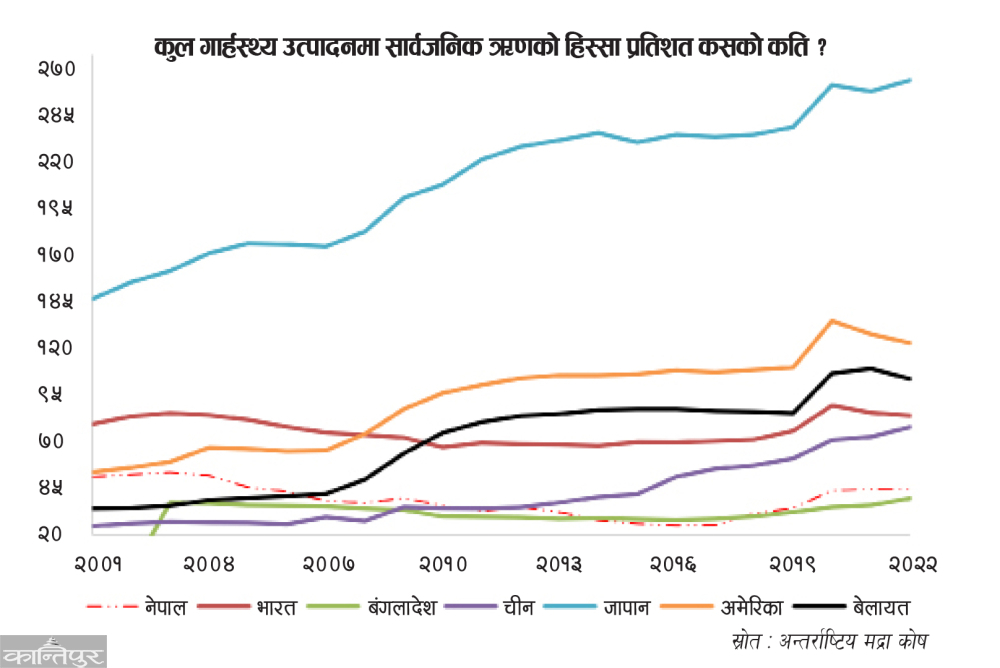

data shows where we are. However, we also think that these are all relative matters. When we compare ourselves to others, we may sometimes be underestimating or overestimating ourselves. In order not to do so, some historical, exemplary and neighboring countries' data are shown in the presented graph. Our neighboring countries India and China have made good progress in recent times. The data of Bangladesh, which is being upgraded from an underdeveloped country to a developing country, Japan, a developed Asian country with a lot of public debt, the United States of America, which is considered a pioneer of modern development, and the UK, a historic country in terms of development and expansion, have been used in this.

The presented graph conveys four clear messages. First, the extent of public debt may vary from country to country, but it is increasing in most countries. It is also clear that no country can develop without investment, if they do not have resources, without using loans. Secondly, the country will not become poor if this share is higher, if that were the case, Japan would not have the level of economic status it is today. Despite being large economies, our neighbors India and China have used public debt for nearly 85 and 80 percent of their GDP respectively. Other countries have also been increasing this share in recent years. Thirdly, Japan, Britain, and the United States are witnesses of the fact that they can increase this share by more than 20 percent in a single year when there is a need or when the economy is going through problems. Nepal has also increased from 34 percent to 43 percent. Fourth, in Nepal this share reached 53 percent in 2003.

What to spend the loan on?

Some proverbs and sayings are popular among us. Like - 'To spend a diamond on a chance, not to leave a penny on a bad chance', 'To have fun by paying off debt is to be safe'. Also, the 'Dutch Disease' story that easy money brings misrule is also established in economics. The experience of developed countries and our sayings also show that the economy cannot be sustained by earning money at the expense of development. So even though we don't have fiscal space, we still have debt space, but the condition is that it should be used only for capital expenditure. May it also make the economy run and development and construction work be completed.

conclusion

Although the big impact on our economy was not seen at the time, the effects of Covid-19 and the Russia-Ukraine war are still being seen. The economy is yet to sustain its rhythm. There is great frustration and confusion in the lower and lower middle classes, while the upper middle and upper classes are panicked due to some incidents in the country. Due to this, investment and consumption have decreased. Its leadership is also saying that the private sector cannot play a bigger role due to this. In this case, the government should naturally be both the guardian and the doer of the economy. The government has no fiscal space but debt space remains. Now some multilateral lending sources are willing to invest (lend) in education, health, sustainable infrastructure, youth, building a circular economy, while public debt accounts for 53 percent of our GDP (2003 equivalent). By doing so, we can increase the capital expenditure budget by up to 500,000 and the government can also do some new transformational work as proposed by the Sixteenth Plan. If that happens, the financial transactions will increase and the economy will be able to run. For that, all of us must increase our ability to carry out institutional reforms and capital expenditures.

(Paudel is a member of the National Planning Commission.)

प्रकाशित : चैत्र १, २०८० ०८:४५