A rigid governor's flexible monetary policy

We use Google Cloud Translation Services. Google requires we provide the following disclaimer relating to use of this service:

This service may contain translations powered by Google. Google disclaims all warranties related to the translations, expressed or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose, and noninfringement.

Highlights

- According to the responses of the private sector, government agencies and experts, Nepal Rastra Bank Governor Mahaprasad Adhikari has tried to convince everyone through the last monetary policy of his five-year tenure.

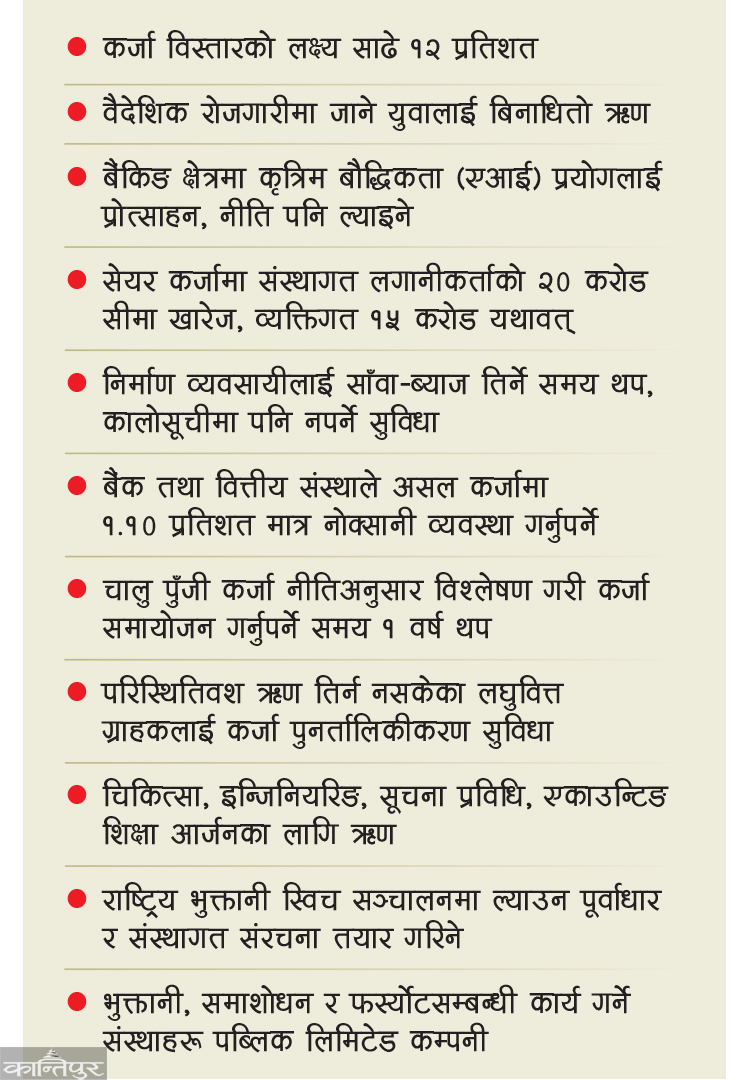

Rashtra Bank Governor Mahaprasad Adhikari, who has been accused of bringing relaxation to the economy as a whole due to the harsh policy, has this time announced a flexible and expansionary monetary policy. Rastra Bank has taken a loose policy on foreign exchange rate, interest rate of loans taken by the bank from Rastra Bank, working capital loan guidance, real estate, share trading and increase in operational profit of banks and financial institutions.

Rastra Bank has extended the period of non-performing loan classification in some areas.

Based on feedback from private sector, government agencies and independent experts, Governor Adhikari has tried to convince everyone through the final monetary policy of his five-year tenure.

has specifically addressed the construction business sector, which is addressed at a point in the past monetary policy. After reviewing the loan arrangements for micro, domestic, small and medium enterprises, they have announced that they will give cheap loans to industries related to domestic production, including agricultural support industries, agricultural tools production, information technology, and tourism.

Forgetting the background that the expected improvement in economic activity is not happening and that the private sector is over-indebted as stated by the National Bank, the ambitious target of 12 percent credit expansion has also been taken.

The facilities given to the construction sector, the lower limit of the provision of losses for good loans, the new arrangement to be counted in the capital fund, the abolition of the limit of institutional share loans, the flexible policy on the blacklist, the arrangement regarding unsecured loans for foreign employment, and the policy to encourage sector loans this year. Rashtra Bank claims that the credit expansion will be significant. Banks and financial institutions will have to expand loans by an additional 6 trillion 54 billion 75 crore rupees this year in order to fulfill the ambition of 12.5 percent credit expansion as claimed by the National Bank. Last year, the target of expanding credit by 11 and a half percent was set, but only around 7 percent, i.e., only 3 trillion 44 billion 72 crores of credit was disbursed last year.

Rashtra Bank Governor Mahaprasad Adhikari has claimed that the economy will be sustainable as credit expansion will increase due to the new arrangements made through monetary policy. We have implemented various methods and tools to manage the pressure of capital funds in banks. It will ease the capital fund pressure on banks and financial institutions," he said. "Even though banks and financial institutions have sufficient liquidity, they could not extend loans because they could not manage their capital funds. Facilitating it means increasing credit in the market. That's why we have set a target of 12.5 percent credit.'' Market demand and investment should increase for loan expansion. Experts say that the mentioned target is ambitious as the credit expansion will not increase until the private sector is discouraged and their confidence is increased. "The goal of credit expansion towards the private sector has become very ambitious," said Chartered Accountant Analraj Bhattarai, "Looking at the current capital adequacy base and increasing bad credit ratio, about 62 billion more capital is needed for 12.5 percent more credit expansion." It will be very difficult for the banks to increase that capital. He said that investors are not willing to expand more capital in the banking sector due to the arrangement proposed in the Bafia Bill pending in the Parliament. "Credit expansion is not possible without increasing capital and as banks are unable to increase additional capital when managing old loans is difficult, credit expansion according to the target is not possible." The period for paying the principal and interest of the loans given to the builders has been extended till the end of November 2081, and until further arrangements, it is said that they will not be included in the blacklist only on the basis of dishonored checks. There are separate provisions regarding credit rating limits, relief from blacklisting, etc. in loans taken for construction business. It is also expected to facilitate the bank in bad debt management.

According to the Governor's officer, the expansion of credit will also be supported due to the fact that some arrangements have been made in the monetary policy to facilitate the construction sector, which is in trouble without receiving payment from the government. After the problems related to the construction sector and the cooperative sector, it has seen a multi-faceted effect. There was a situation where the builders didn't get the money, the checks bounced when they didn't get the money, they were blacklisted when the checks bounced, their bank accounts were closed after being blacklisted and they couldn't do anything after the bank accounts were closed, he said.

Through monetary policy, the share loan limit of 20 crores has been abolished for institutional investors. The limit of 150 million in share mortgage loans for individuals remains. He said that behind removing the limit of institutional share mortgage loans, the aim is to increase loans from banks and financial institutions. On the institutional side, removing the limit of 20 crores on share mortgage loans is not intended to affect the capital market. We have tried to look at the loans from banks only," said the official.

There are no new programs for real estate, hire-purchase and other sectors. Loans of up to 20 million in agriculture, small, domestic and medium enterprise business have been implemented to be counted in the regulatory retail portfolio. As this arrangement will relieve the capital fund of banks and financial institutions, their credit disbursement capacity will increase and the cost will also decrease. Rashtra Bank claims that this will increase credit flow in those areas.

While Governor Adhikari is claiming that the monetary policy will facilitate the economy, Prime Minister KP Sharma Oli and Deputy Prime Minister and Finance Minister Bishnu Paudel have also supported it on Friday. Prime Minister Oli has said that the monetary policy has come to help solve the problems of the economy. Addressing after the swearing in of officials of the National Planning Commission, he said that it is positive to get support for the monetary policy. "It is a very good thing that the new officials are supported and welcomed by the monetary policy," he said, "We now have to work with speed and increase the capacity of all Nepalis." "Monetary policy is good," Finance Minister Paudel said, "Monetary policy will help expand credit and increase investment in the production sector." Monetary policy seems to address most of the sectors this time. The bank rate of the upper limit of the interest rate corridor has been reduced from 7 percent to 6.5 percent and the policy rate from 5.5 percent to 5 percent. This is the interest that banks and financial institutions have to pay when they take a loan from the National Bank. As it decreases, the cost of the loans will be lower, so the interest rate of the loan will be lower. Experts say that there is more liquidity in the market now, so the interest rate will not be affected much.

Although there is enough liquidity, it seems that the capital fund is under pressure due to the increase in bad loans. This means that their credit expansion capacity was reduced due to the provision of funds for bad loans. The policy mentions encouraging the use of capital fund tools and new tools by banks and reducing the existing 1.20 percent loan loss provision on good loans to 1.10 percent. Bankers say that this arrangement will increase the operating profit of banks and financial institutions by about 5 billion. The policy also mentions the necessary review of the risk weighting arrangements for loan purchase and sale.

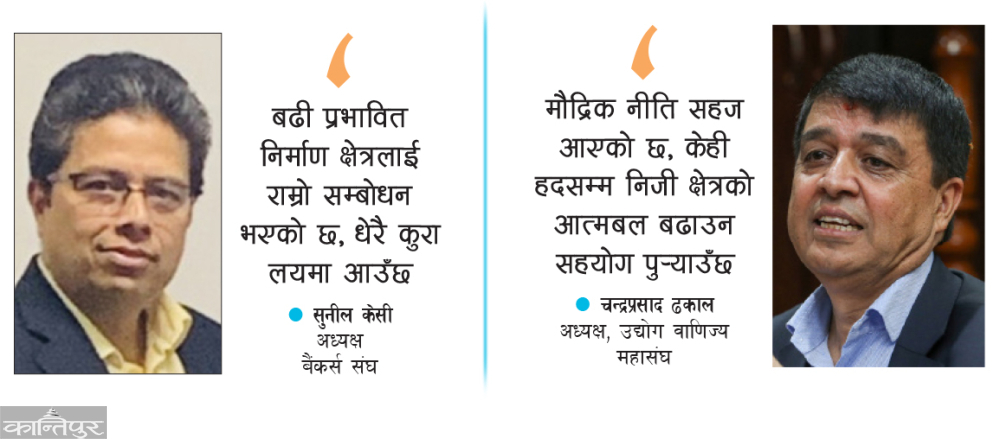

Sunil KC, President of the Bankers' Association, said that since banks are unable to extend loans due to three reasons, namely excess liquidity, bad credit management and capital fund pressure, the monetary policy is trying to address those problems. "Now the most affected is the construction sector. It seems that the sector has been well addressed,' he said, 'Because the problem seen in the construction sector has an impact on the economy, many things will come into rhythm when it is resolved.' The system will be modified and classified in the micro surveillance category for 6 months and the system will be arranged to be classified in the good category only after that period,'' said the monetary policy. Experts say that this arrangement will reduce the loan loss arrangement and non-performing loans of banks and financial institutions and increase their profits. The arrangement to adjust the loan by doing 'Variance Analysis' mentioned in the current capital loan guidance has been extended to be applicable only from 1st July 2008. This policy has given an additional period of one year for adjustment of current capital loans. It is said that this will give relief to businessmen.

President of Federation of Nepal Chamber of Commerce and Industry Chandra Prasad Dhakal said that the National Bank has come up with a positive monetary policy to facilitate credit expansion. "The goal of extending credit to the private sector of 12.5 percent is positive," he said, "The problem of construction workers has been addressed, making the process of calculating the bank's good credit for 6 months is a good aspect to facilitate the taking of loans from banks and financial institutions." It has been seen that loans from banks and financial institutions have been facilitated. He said that the monetary policy will help to expand the loans of banks and increase the demand.

It is said that the current capital loan guidelines being raised by the private sector will be revised. Monetary policy has been positive. The limit of institutional loans in the stock market has been abolished. It also makes monetary policy positive. The problems in the construction sector affected the overall economy. It has been addressed by monetary policy," he said. "Monetary policy has come easily. It will help to increase the self-strength of the private sector to some extent. Rajesh Kumar Agarwal, President of Nepal Industry Confederation, said that although the monetary policy has addressed the problems of the construction industry, it has not been addressed as expected in the manufacturing industries. "Overall, it looks good, but facilities such as restructuring and rescheduling should have come to solve the problems of the manufacturing industries, that was not seen," he said.

The limit of 1 crore set for micro, domestic, small and medium enterprises is going to be reviewed. The monetary policy provides that microfinance customers who are unable to repay their loans due to circumstances can reschedule their loans by paying a certain percentage of interest. As mentioned in this year's budget, there is also a provision in the policy to provide unsecured loans based on the assurance of sending remittances to the bank accounts of those who have obtained work permits for foreign employment. "The existing limit of surface facility available for importing goods through Draft/TT will be increased from US$35,000 to US$50,000," the monetary policy said, "The existing limit for imports through DAP/DAA will be increased from US$60,000 to US$50,000." One million dollars will be maintained.'

प्रकाशित : श्रावण १२, २०८१ ०५:२४

प्रकाशित : श्रावण १२, २०८१ ०५:२४

२२.१२°C काठमाडौं

२२.१२°C काठमाडौं