Why stopped monetary policy?

We use Google Cloud Translation Services. Google requires we provide the following disclaimer relating to use of this service:

This service may contain translations powered by Google. Google disclaims all warranties related to the translations, expressed or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose, and noninfringement.

Highlights

- The Rashtra Bank Nazwaf, the Ministry of Finance and the Prime Minister's Office claimed that there was no intervention on the question of when the monetary policy, which was supposed to be introduced last Friday, would come.

The National Bank had called a meeting of the board of directors at 8 am last Friday with the plan to announce the monetary policy after completing the preparations. The National Bank is not able to answer why it was stopped and when it will come again.

The question has been referred to the higher authorities, but the Prime Minister and Council of Ministers Office and the Ministry of Finance have claimed that they have not interfered. According to another official of Rashtra Bank, at the last moment the directive came from the Prime Minister's Office to stop the monetary policy. After that, even on Monday, there was no signal from the government.

The procedure states that the monetary policy will be introduced within 15 days of the end of the financial year. It should be brought in the next week, but it is not possible to say which day it will come," said an official of the National Bank. The National Bank usually brings monetary policy in the first week of July. Monetary policy was announced on July 7 in 080/81 and on July 6 in 079/80. In the financial year 078/79, due to the intervention of the government, the National Bank announced the monetary policy only on July 29.

On the day before the Board of Directors meeting called by the National Bank, the Council of Ministers meeting on Thursday appointed Bishnu Rimal as the chief political advisor to Prime Minister KP Sharma Oli and Yuvraj Khatiwada as the development advisor.

A message from the Prime Minister's Office to Rashtra Bank was sent to Rashtra Bank on Thursday evening saying, 'Don't announce the monetary policy on Friday.' The agenda of the meeting was also to discuss monetary policy," said an official of Rashtra Bank, "The meeting was held on Friday at the scheduled time. The swap regulations were passed at the beginning of the meeting. Then the audit report of two commercial banks was discussed. One of them passed but the other did not. This was followed by a nuanced discussion on the monetary policy landscape and international practice. Coming to the main policy, the governor said that I have yet to see the full draft, after seeing it, let's discuss it in the next meeting. And the meeting is over.'

Since then, monetary policy has not been discussed in the relevant departments of Rashtra Bank, and the meeting of the Board of Directors has not been held. Even if the monetary policy is stopped for some reason, there is no reason for differences between the government and the National Bank. UML President Oli is the Prime Minister and UML Vice President Bishnu Paudel is the Finance Minister. Rashtra Bank Governor Mahaprasad Adhikari was appointed by the previous government led by Oli. "I think that the Prime Minister, the Finance Minister and the recently appointed Development Advisor Khatiwada have pushed back some changes in the monetary policy," said an official of Rashtra Bank, "This may be being discussed between the government and the governor."

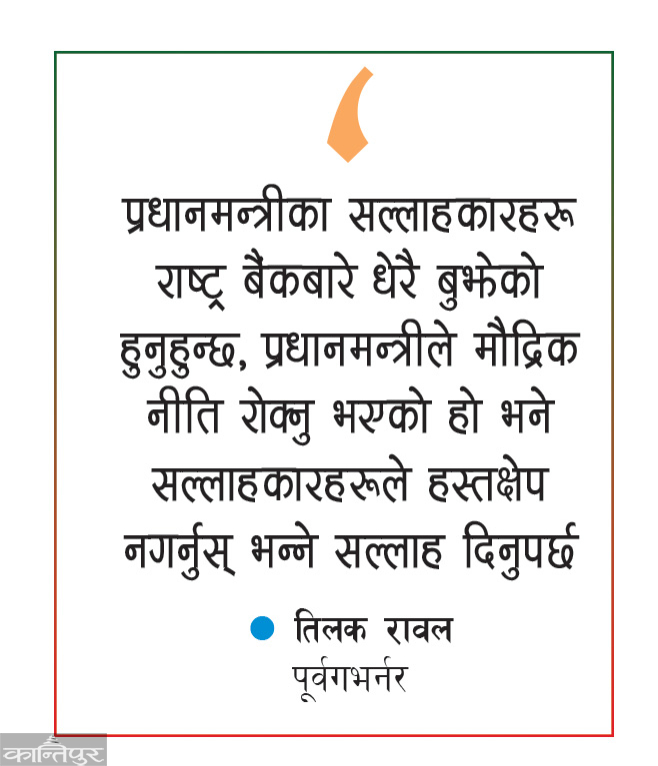

Although there is a provision that the government can give instructions to the National Bank on a theoretical matter, it cannot interfere in the policy. Former Rashtra Bank Governor Tilak Rawal said that if the government or the Ministry of Finance stopped the monetary policy, it would not be right from any side. "It is not a good practice to suddenly stop what the National Bank wanted to issue last Friday, when the meeting of the Board of Directors has been called accordingly," he said. He said that since the Finance Secretary is the representative of the government, the Prime Minister or the Finance Minister himself interferes. Former Governor of Rashtra Bank Dipendra Bahadur Chhetri said that people who have reached the position of

tend to forget their responsibilities and scope and as a result, the government intervenes on the monetary policy. Financial policy and monetary policy have their own scope and scope. The government can give suggestions, advice and if necessary to each other,' he said, 'but it is not good to interfere directly in the daily operations of the National Bank.' It is said to stop for a few days. Rashtra Bank has a system. It does not go beyond its scope, but if there is something, the government can put it through the finance secretary, but it does not interfere itself," said former governor Chhetri.

There is a provision in the National Bank Act that the government can give instructions on economic matters. That provision is not meant to interfere with day-to-day operations. But Chhetri says that the government is showing its power by adopting the same provision. The National Bank and the Ministry of Finance have given a formal response and stated that there is no interference in the monetary policy delay. Dilliram Pokharel, co-spokesperson of Nepal Rastra Bank, said that the draft monetary policy was submitted at the meeting of the board of directors last Friday and after the directors asked for time for study, it was extended for a few days. The draft was submitted in the meeting of the board of directors last Friday, and it was also discussed. Then the directors said let's study more," he said, "Now the study is in progress."

Finance Minister Poudel also said that the Ministry of Finance did not interfere in the monetary policy. In a meeting with officials of Nepal Hotel Association (HAN) on Monday, he said that the monetary policy is being discussed and will be released within a few days. "Monetary policy comes to address the deficit in the economy," he said.

The Rastra Bank, which has been ruthless in credit expansion for the past two years, has prepared to introduce a looser policy this year. Due to the lack of demand for loans, around 8 trillion rupees of investable funds have been accumulated in banks and financial institutions, interest rates have dropped significantly, remittances are increasing, foreign exchange reserves, and remittances are strong, and the National Bank is trying to include measures to encourage credit expansion in the new monetary policy. ;

The slowdown seen in the economy has not been improved, the growth of the construction and industrial sector, which uses a lot of credit, is negative, so the interest rate is continuously decreasing, and the demand for credit has not been able to rise. In the last year, almost 7 billion deposits were collected, while the loan disbursement is less than 3 billion. During that period, deposit collection is around 11 and a half percent and loan disbursement is only around 6 percent. Credit expansion is about half of the target. Last year, the National Bank had set a target of expanding loans by 11.5 percent.

In the previous financial year, the deposit collection was 6 trillion 12 billion (growth rate of 11.31 percent) while the credit expanded to 1 trillion 64 billion (growth rate of 3.38 percent). The credit demand was expected to increase since the beginning of the last financial year due to improvement in the external indicators of the economy, falling interest rates, and sufficient liquidity. But as the economic situation did not improve as expected, credit flow did not increase as expected. Sources said that since there is enough liquidity in the market and the interest rate is also decreasing, it is not possible to use the policy rate (the interest rate paid by banks and financial institutions when taking loans from the National Bank) through monetary policy. Currently the policy rate is 5.5 percent. There has been extensive discussion on whether to revise the mandatory cash ratio (CRR).

In the past, the arrangement regarding the establishment of an Asset Management Company (AMC), which has been discussed for a long time and has been mentioned in the monetary policy many times but has not been implemented, is sure to be included in the monetary policy. According to the source, this time the Rastra Bank will address the monetary policy regarding the establishment of an asset management company in view of the increasing bad loans of the banks, the decrease in the ability of the banks to provide additional loans while arranging the losses due to the bad loans, and the fact that the assets were not sold for debt recovery. Nothing is said about how the company will be, regulatory arrangements etc. But something may come about setting up a company,” the source said.

Many investors expect the equity market to be less likely to be addressed by monetary policy. "There have been suggestions such as raising the limit for taking loans from sectors such as shares, real estate, auto, and reducing the risk burden," the source said, "but these sectors must be addressed in one way or another." Currently, the limit for share loans is 150 million for individuals and 200 million for organizations. "If the said provision is completely removed, there may be accusations that the policy is not stable, so the limit can be increased or the said provision can be removed for institutions," said the source.

Similarly, there is a possibility of revising the 15 percent interest rate limit set for microfinance institutions. Sources claim that the monetary policy is unlikely to deal with issues such as subsidized interest loans, re-loans, etc. directed by the budget. "Since the advisors of the current prime minister, the finance minister and the ministry are aware of this homework, they may have their own expectations," a Rashtra Bank source said, "That's why we conclude that the monetary policy has been stopped."

प्रकाशित : श्रावण ८, २०८१ ०५:५४

प्रकाशित : श्रावण ८, २०८१ ०५:५४

२२.१२°C काठमाडौं

२२.१२°C काठमाडौं